In the entry of July 11th, I commented on Gail Tverberg’s list of monetary problems that arise in connection with energy technologies. The EROI that was already too low was computed using the methodology employed by Charles Hall. (In his recent collaboration with Pedro Prieto, Hall added many (but not all) of the items to the energy investments necessary to determine sustainability, quasi-sustainability, or feasibility as defined in my post of August 14th.) I include part of Gail’s article and my comments below.

In my earlier comment, I neglected to mention that, if the monetary deficits are known, there is no reason not to convert money to energy according to the methodology mentioned in the comment and get a better estimate of ERoEI. In case, Pedro’s methods were employed, one must be careful not to double count the energy consumed by employees to maintain their standards of living.

Now, Pedro said that he accounted for the employees; but, he did not promise that he counted the total increase in the world energy budget due to the employees being paid at all. The energy invested term should be increased not only by the entire energy budgets of the employees but also by the increase in the energy budgets of everyone who receives any of that money when it is spent. There are multiplication factors to aid the analyst in doing this.

In my earlier comment, I neglected to mention that, if the monetary deficits are known, there is no reason not to convert money to energy according to the methodology mentioned in the comment and get a better estimate of ERoEI. In case, Pedro’s methods were employed, one must be careful not to double count the energy consumed by employees to maintain their standards of living.

Now, Pedro said that he accounted for the employees; but, he did not promise that he counted the total increase in the world energy budget due to the employees being paid at all. The energy invested term should be increased not only by the entire energy budgets of the employees but also by the increase in the energy budgets of everyone who receives any of that money when it is spent. There are multiplication factors to aid the analyst in doing this.

Indeed, the list items are of different types. If the project is never built because funds of one type or another are not available, we can treat the item either as a hypothetical energy investment expense or a barrier. It is not fair to charge different rents for necessary plots of ground to different instances of the same technology; therefore, land should be given a separate account and charged at the rate of insolation or wind area number or merely counted toward Maximum Renewables as I did in http://dematerialism.net/CwC.html .

Private profit is an energy expense. The analyst must compute the difference in the world energy budget as he did for wages. If sustainability is under investigation, the energy costs of pollution must be reckoned as in the post of December 8th, 2012. Otherwise, the best one can do is to determine feasibility.

In any and every case, Gail’s conclusion is probably still correct, namely, that ERoEI is less than 1.0 and more research in energy technology must be supported. This represents an energy burden that must be borne by the entire energy sector.

Private profit is an energy expense. The analyst must compute the difference in the world energy budget as he did for wages. If sustainability is under investigation, the energy costs of pollution must be reckoned as in the post of December 8th, 2012. Otherwise, the best one can do is to determine feasibility.

In any and every case, Gail’s conclusion is probably still correct, namely, that ERoEI is less than 1.0 and more research in energy technology must be supported. This represents an energy burden that must be borne by the entire energy sector.

Gail Tverberg’s List

Primary problems

1. Funds are not available to pay for fossil-fuel subsidies for renewable energy projects.

2. Wages consistent with financial solvency and private profit are too low.

3. Energy production companies, especially heavily front-loaded renewable energy production such as photovoltaic solar energy installations, need to borrow money that the credit system can no longer supply.

4. There are insufficient financial returns to pay taxes desperately needed by governments.

2. Wages consistent with financial solvency and private profit are too low.

3. Energy production companies, especially heavily front-loaded renewable energy production such as photovoltaic solar energy installations, need to borrow money that the credit system can no longer supply.

4. There are insufficient financial returns to pay taxes desperately needed by governments.

Secondary problems

1. Private profit from energy production is seen as inadequate by corporations.2. Rent cannot be paid for land used in energy production. This cost might be highest in bio-fuel operations, but it belongs to every process that harvests sunlight in real time.

3. Insufficient funds are available to prevent pollution and mitigate its effects. These costs are never paid unless mandated by law - if then.

4. Energy production companies do not pay to prevent mineral depletion and degradation of soil or even try to nor do they pay fines for failure.

5. Energy producers do not account for limitations in so-called free energy. For example, there ought to be a cost premium charged to the process for using limited coastal or off-shore wind power sites.

3. Insufficient funds are available to prevent pollution and mitigate its effects. These costs are never paid unless mandated by law - if then.

4. Energy production companies do not pay to prevent mineral depletion and degradation of soil or even try to nor do they pay fines for failure.

5. Energy producers do not account for limitations in so-called free energy. For example, there ought to be a cost premium charged to the process for using limited coastal or off-shore wind power sites.

Gail Tverberg, the actuary, in the article posted by Jay

Hanson, wrote, "Commenters frequently remark that such-and-such an energy source has an

Energy Return on Energy Invested <http://en.wikipedia

<http://en.wikipedia.org/wiki/Energy_returned_on_energy_invested>

.org/wiki/Energy_returned_on_energy_invested> (EROI) ratio of greater than

5:1, so must be a helpful addition to our current energy supply. My finding

that the overall energy return is already too low seems to run counter to

this belief. In this post, I will try to explain why this difference occurs.

Part of the difference is that I am looking at what our current economy

requires, not some theoretical low-level economy. Also, I don't think that

it is really feasible to create a new economic system, based on lower EROI

resources, because today's renewables are fossil-fuel based, and initially

tend to add to fossil fuel use."

It is true that alternative energy installations that employ photovoltaic

cells, for example, incur heavy energy investment expense before any energy

at all is returned. In a US-type market economy, the fossil-fuel debt that

must be incurred early in the life cycle of such an installation might never

be repaid. That is because, in a market economy, significant energy

investment expense is required just to operate the market [1]. This expense

is never recorded in conventional approaches to ERoEI analysis such as

Charlie Hall's methodology which has received widespread attention.

Moreover, the energy costs of private profit, borrowing money, paying taxes,

paying adequate wages to employees and other economic actors who make

part-time contributions to producing energy such as the energy employee's

health-care providers, auto mechanics, tax accountants, and other indirect

energy expenses at all levels, including, for instance, the appropriate

pro-rata share of the energy executive's insurance company's actuary, are

not counted. Thus, Gail - or anyone else - has no idea if EROI = 5 is

adequate or not.

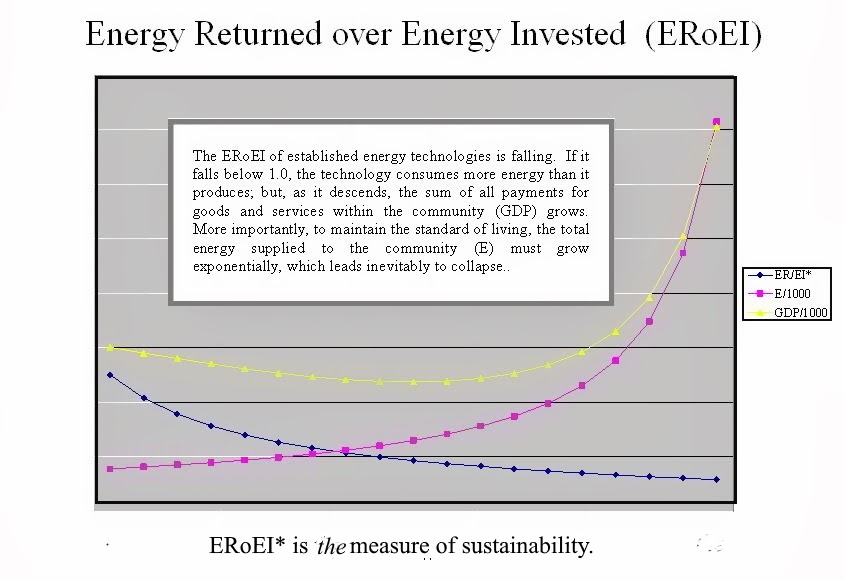

In ERoEI* (pronounced "E R o E I star") as described at

http://dematerialism.net/eroeistar.htm and on my blog at

http://eroei.blogspot.com/ all of these and every other facet of energy

technology that influences sustainability and whether or not the technology

will actually be employed is considered; so, when the analysis is complete,

the analyst knows that an ERoEI* greater than 1.0 is adequate with as much

certainty as went into the collection of his raw data.

In "Energy in a Mark II <http://dematerialism.net/Mark-II-Economy.html>

Economy" I analyzed the meaning of the ratio of Total Energy Budget over

Gross Domestic Product for an entire economy, some form of which the DOE

records for every nation and every year. It might be interesting to obtain

similar ratios for each individual sector including the government and

finance sector to aid in converting Gail's monetary expenses into

appropriate energy expenses. If nothing else, we could then determine if

Gail's threshold figure of 5.0 make any sense at all.

[1] In "Energy in a Mark II

<http://dematerialism.net/Mark-II-Economy.html> Economy" I employed the

figure of 22% of the total energy budget that the US Department of Energy

(DOE) charges directly to commerce. Of course, some portion of the energy

consumed by transportation and manufacturing should be charged to commerce

and finance as well. Moreover, if an entrepreneur extracts a large profit

from his - usually subsidized - renewable energy business and builds an

overly large house, additional energy costs should be charged to the energy

installation. This amounts to some fraction of the energy charged by the

DOE to the residential sector. In "Energy in a Natural Economy

<http://dematerialism.net/ne.htm> " I found a rough estimate of the energy

overhead of the US market economy by looking at Bureau of Labor Statistics

data.

Tom Wayburn, Houston, Texas

P.S. In the entry of July 11th of http://eroei.blogspot.com/ I wrote the

following paragraph in connection with establishing a reasonably sane

monetary system partly in response to Gail Tverberg's list (see below):

Special Characteristics [of a monetary system] Needed to Avoid Economic

Collapse

Our crisis has a physical component and an imaginary component. The physical

component comes from limitations in the quantities of land, water,

consumable energy, and the environment itself. The ecological footprint of

the human race exceeds the carrying capacity of Earth. The imaginary

component is instability in the monetary system caused by excessive debt and

excessive monetary inequality. To ameliorate the physical crisis we must

eliminate the imaginary one. I do not mean that indebtedness, poverty, and

wealth are imaginary; but, rather, that we can eliminate all three with the

application of our imaginations without affecting the physical universe.

Stabilizing our population and reducing our ecological footprint will

ultimately have a desirable effect upon the universe.

Regardless of what the people want, the owners of the country want to retain

their positions of power, privilege, and wealth. Naturally, they despise the

idea of government control of the economy and the means of production;

however, when a crisis arises that they cannot handle, they readily accede

to crisis socialism to save them. During World War II, without adopting

socialism completely, they allowed rationing, wage and price control, and

management of vital industries by government employees even if they were

paid only one dollar per year.

To respond appropriately to resource and environmental limits, we need to

establish crisis socialism. However, to eliminate debt, we need to repudiate

the US dollar; and, to eliminate inequality, we need to pay everyone the

same even if no work can be found for them to replace the inessential work

from which they were furloughed to reduce our consumption of fossil fuels

and our ecological footprint. After all, the requirement that every citizen

does useful work to get paid and the requirement that the pay should be

commensurate with the value of the work are completely imaginary. The idea

that everyone should be allowed to get as much money as he can is completely

wrong. (One of the reasons Dematerialism is right and everything else is

wrong is that any society in which it is possible for one person to acquire

more wealth than another is doomed.)

*Adequate Return for All Elements Required for Energy Investment*

In order to extract oil or create biofuels, or to make any other type of

energy investment, at least four distinct elements described in Figure

1: (1) adequate payback on energy invested, (2) sufficient wages for

humans, (3) sufficient credit availability and (4) sufficient funds for

government services. If any of these is lacking, the whole system has a

tendency to seize up.

EROI analyses tend to look primarily at the first item on the list,

comparing "energy available to society" as the result of a given process

to "energy required for extraction" (all in units of energy). While this

comparison can be helpful for some purposes, it seems to me that we

should also be looking at whether the*dollars collected*at the

end-product level are sufficient to provide*an adequate financial return

to meet the financial needs of all four areas*simultaneously.

My list of the four distinct elements necessary to enable energy

extraction and to keep the economy functioning is really an abbreviated

list. Clearly one needs other items, such as profits for businesses. In

a sense, the whole world economy is an energy delivery system. This is

why it is important to understand what the system needs to function

properly.

More here

http://www.theoildr <http://www.theoildrum.com/node/10052> um.com/node/10052

http://www.theoildr <http://www.theoildrum.com/node/10052> um.com/node/10052